DÉFINITION

The budget is an important act in the life of a municipality, it determines the main axes of decisions.

It is a legal act of financial forecasting and authorization voted by the deliberative assembly.

The preparation of the budget falls under the competence of the mayor and is ensured by the financial services of the community. It requires an assessment of expenditure and revenue. It can change during the year through additional budget or amending decision. In addition, additional budgets trace the financial flows of particular services (example: the creation of a housing estate).

PRÉSENTATION

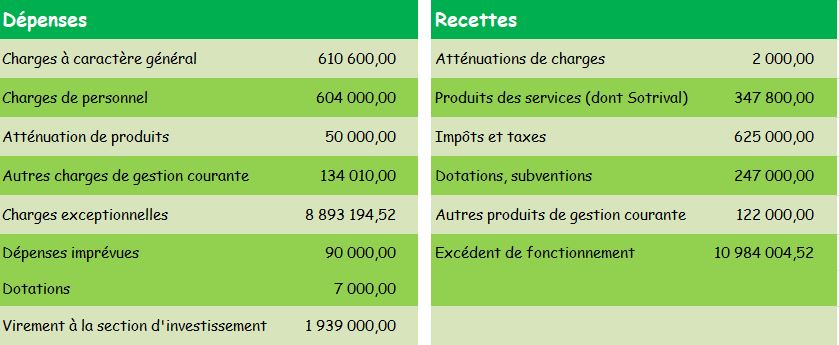

The budget structure has different parts: the operating section and the investment section, each of which consists of an expenditure column and a revenue column. Within each column, there are chapters corresponding to each type of expenditure or revenue, these chapters being themselves divided into articles.

The operation section includes:

- all expenses necessary for the functioning of the community (general expenses, personnel, day-to-day management, interest on debt, depreciation allowances, provisions);

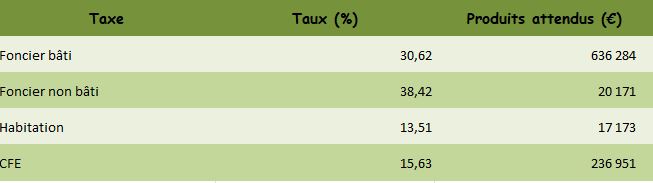

- all revenue that the local authority may receive from transfers of charges, services, state grants, taxes and duties and, possibly, reversals of provisions and depreciation that the local authority may have made. These include the product of the four major local direct taxes, the global operating grant (DGF) and the general decentralization grant (DGD).

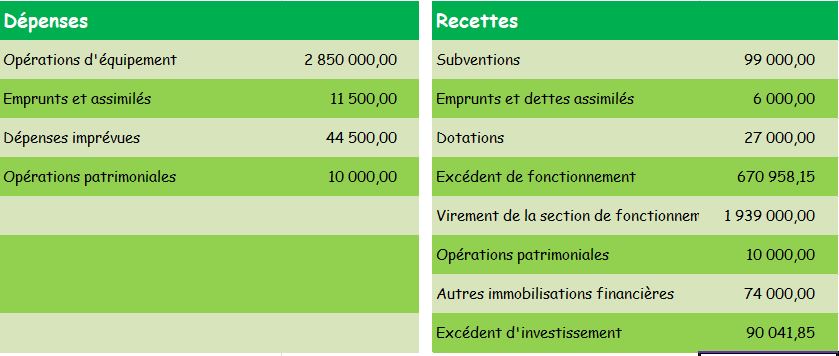

The investment section includes:

- in expenses: debt repayment and community equipment expenses (work in progress, operations on behalf of third parties, etc.);

- in revenue: loans, endowments and grants from the State. There is also a recipe of a particular kind, self-financing, which actually corresponds to the surplus balance of the operating section.

BUDGETARY PRINCIPLES

These principles are five in number and are subject to control exercised by the prefect, in liaison with the regional chamber of accounts (CRC) within the framework of what is called budgetary control.

The principle of annuality requires:

- that the budget be defined for a period of twelve months from January 1 to December 31;

- that each community adopts its budget for the following year before January 1st, but a deadline is given to them by law until April 15th of the year to which the budget applies, or until April 30th, the years of renewal of local assemblies.

The rule of real balance implies the existence of a balance between the revenue and expenditure of local authorities, as well as between the different parts of the budget (operating and investment sections).

The principle of unity presupposes that all revenue and expenditure appear in a single budget document, the general budget of the local authority. However, other budgets, known as annexes, can be added to the general budget in order to trace the activity of certain services. Thus the budget of the social action center is annexed to the general budget of the municipality. Industrial and commercial public services managed directly by the municipalities must, for their part, be included in an additional budget.

The principle of universality implies:

- that all expenditure and revenue operations are indicated in their entirety and without modification in the budget. This is in line with the requirement for sincerity in budget documents;

- that revenues finance expenditures. This is the universality of recipes.

The principle of specialization of expenses consists in authorizing an expense only to a service and for a particular object. Thus, the appropriations are allocated to a service, or to a set of services, and are specialized by chapter grouping the expenses according to their nature or according to their destination.

BUDGET 2023

For the year 2023, the municipal budget was voted on March 24 and looks like this: